In today’s fast-paced healthcare landscape, independent pharmacies play a vital role in delivering personalized care and fostering strong community connections. However, these pharmacies face numerous challenges that threaten their financial viability and delivery of quality services. When I chose my initial career path as a pharmacy student, I admired those courageous classmates who decided to strike out on their own and open a new pharmacy business. How does one gain the market research insight, business understanding, and strategy to open an independent pharmacy or expand an existing one? This blog aims to shed light on the obstacles encountered by independent pharmacies, propose potential solutions to overcome them, and explore future growth projections.

Competitive Pressure from Chain Pharmacies and ePharmacies

One of the significant challenges faced by the over 23,000 independent pharmacies nationwide is intense competition from large chain pharmacies. These chains often enjoy greater buying power, marketing budgets, inventory, and operational efficiency, making it difficult for independent pharmacies to compete on price and convenience. However, independent pharmacies, also called “independents”, can differentiate themselves by focusing on personalized care, community involvement, innovative and differentiated services, and building strong relationships with customers. Rural location also favors independent pharmacies, where they can provide important services to traditionally underserved patient populations. While independents comprise 38% of all retail pharmacies, they make up 52% of all rural stores. By emphasizing their unique advantages, such as providing personalized medication counseling, approaches to improve patient medication adherence, specialty services, niche products, and improved patient accessibility, independent pharmacies can create loyal customers, appreciative of the individual attention they receive.

A significant disruptor to all genres of pharmacy box stores is mail-order businesses. Online pharmacies, or ePharmacies, have a CAGR of 17.3% through 2026, valued at $177,794.9M. Two notable online pharmacies include Amazon Pharmacy and PillPak by Amazon Pharmacy. Amazon purchased PillPack, Inc. in 2018, which organizes multiple medications into packets, divided by date and time. In 2020, Amazon Pharmacy launched a Prime 2-day mail order delivery service that dispensed medication in traditional bottles or other packaging. Since 89% of the US population uses the internet, utilization of e-commerce platforms is expected to grow significantly.

Reimbursement and PBM Issues

Independent pharmacies often struggle with reimbursement rates and complex contracts with Pharmacy Benefit Managers (PBMs). CVS Caremark, Express Scripts (purchased by Cigna), and OptumRx control 80% of the PBM market. Historically, generic sales generated most of independent pharmacies’ profits. However, PBMs negotiate drug prices and reimbursement rates on behalf of insurance plans, often favoring larger chains. This disparity in generic drug reimbursement rates can severely impact the financial viability of independent pharmacies. To address this challenge, independent pharmacies can join buying groups or cooperatives to increase their negotiating power and gain access to better reimbursements. Additionally, advocating for fair legislation and engaging in grassroots efforts can help create a more level playing field.

Evolving Technological Demands

In an era of rapid technological advancement, independent pharmacies face the challenge of adopting and integrating new technologies into their operations. Electronic health records (EHRs), telepharmacy, automated dispensing systems, and online prescription services are becoming increasingly important. However, the cost and complexity of implementing these systems can pose obstacles for independent pharmacies with limited resources. Methods to ensure that independent pharmacist remain competitive in the digitally-driven healthcare landscape include collaborating with technology vendors that offer tailored solutions for independent pharmacies, seeking government grants or subsidies, and fostering partnerships with healthcare organizations or institutions.

Regulatory Compliance

Pharmacy regulations are essential for patient safety and quality care, but can be demanding for independent pharmacies with limited staff and resources. Regulatory compliance with state and federal laws, HIPAA, Medicare Part D, and controlled substance monitoring programs require dedicated time and effort. Independent pharmacies can address these challenges by investing in robust pharmacy management software that automates compliance processes and provides real-time monitoring and reporting capabilities. Additionally, staying current with regulatory changes through professional organizations, attending educational conferences, and engaging with industry experts can help independents navigate complex regulations more effectively.

Growth Forecast

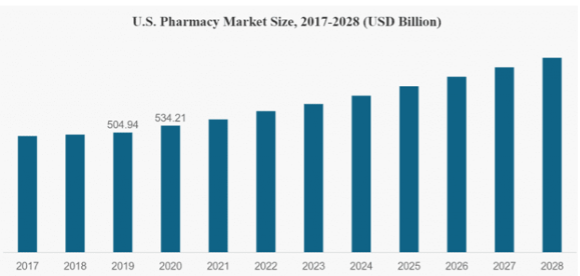

Despite retail pharmacy headwinds, the future of independent pharmacies is bright. Approximately 90% of adults take a prescription medication. The overall US pharmacy market, valued at $534.21 B in 2020, is projected to grow at a CAGR of 6.3% up to $861.67B by 2028 (see Figure 1).

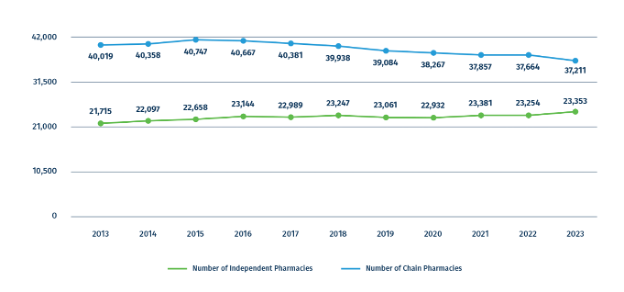

While the biggest market players are the CVS Health Corporation, Walgreens Boots Alliance, Inc., and Cigna, do not discount the benefits of “Mom and Pop” pharmacies. Independent pharmacies dispense nearly half of the nation’s retail prescription medicines, or 1.38B prescriptions per year. The COVID-19 pandemic only increased demand. According to the Pharmaceutical Care Management Association (PCMA), chain pharmacies have been shrinking over the past decade, while independent stores have been increasing (see Figure 2).

Surprisingly, the independent pharmacy space represents a $81.4 billion marketplace, with 80.3 percent of sales derived from prescription drugs. Americans affected by chronic diseases (133M) and those ages 65 years and older (46M) are driving increased demand for medication and pharmacy services. Studies already show that those with lower incomes, greater medication burdens, and increased age seek out independent pharmacy services more than chains.

Looking at sales from the other side of the counter, independent pharmacy in-store sales increased by 6% to 8%, outperforming chain pharmacy growth of 3% to 4%. Independents have more revenue to gain, as over-the-counter (OTC) medication sales are projected to be the fastest growing segment in pharmacies with a CAGR of 6.5% through 2027.

Financial Viability

Maintaining financial viability is a significant concern for independent owners. Rising drug costs, decreasing reimbursement rates, and increasing operational expenses can strain financial resources. To mitigate these challenges, independent pharmacies can explore diversifying their revenue streams by offering additional services such as immunizations, medication therapy management, compounding, or home healthcare supplies. Innovation is key to develop offerings that are low cost, reimbursable, reproducible, and spread by word-of-mouth to generate interest. A wonderful list of differentiated services can be found at the National Community Pharmacy Association’s website. Collaborating with local healthcare providers or clinics to provide integrated care can also help expand the scope of services and improve financial stability.

Conclusion

Independent pharmacies face several challenges that can impact their viability and ability to provide personalized care. However, by leveraging their unique strengths, adopting strategic approaches to scale and differentiate, and embracing innovation, independent pharmacies can navigate these obstacles and create a winning formula for future success.

Starting or growing an independent business in the highly competitive pharmacy industry requires disciplined approaches to strategic planning, technology roadmaps, and customer service excellence programs. For example, CREO’s ISEP strategy methodology is used to help leaders identify the most pivotal aspects of their growth strategy — focusing not on everything, but on the fewest things that will accelerate their growth. Similarly, enterprise architecture disciplines can help organizations rationalize the myriad of technology issues into a phased plan that grows with businesses. Cybersecurity expertise can ensure data privacy and confidentiality. Coaching and data analytic tools can help business owners be accountable to their goals and provide sustained motivation to overcome setbacks. The right balance of the business solutions listed above will improve operational performance metrics, ensuring that independent pharmacy owners remain pillars of their communities and indispensable healthcare providers.

Caroline Girardeau | May 25, 2023

Caroline Girardeau | May 25, 2023