Life sciences and healthcare leaders today continue to face a conundrum. On the one hand, it is clear that data sciences and analytics such as AI can help create a more data-driven, affordable and efficient product development and care delivery ecosystem: design tailored, safe, and effective therapies for rare diseases; streamline drug development; automate high-quality lab and diagnostic services; predict patient demand and care access needs; model disease progression; and countless other use cases. On the other hand, numerous surveys of senior executives by Deloitte, KPMG, SAS, InterSystems, and others have consistently shown that most business leaders do not trust their data and analytics. Beyond the overwhelming number of executives – typically over two-thirds of respondents – expressing this distrust, it’s important to note how persistent this problem has been.

A Brief History of Untrusted Insights

Back in 2006-2007, Thomas Davenport wrote an HBR article and similarly titled book called Competing on Analytics (disclosure: he also generously wrote the foreward to my book). His works captured an idea that had been gradually emerging since ERP, CRM, and business intelligence systems gained traction in the late 1990s and early 2000s: data and analytics were becoming competitive business competencies, and market leaders will be data-driven. As Davenport shared, the early experiences of organizations on the data-driven path showed that trustworthy data and insights were a problem:

“Executives are aware of the [data quality] problem:

in a survey of the challenges organizations face in developing a business intelligence capability,

data quality was second only to budget constraints.”

– Davenport, T (2007). Competing on Analytics,

p. 163, Harvard Business School Press.

Over 15 years later, organizations are still struggling to leverage trusted data to become data-driven. And in many ways, the stakes are even greater today. The volume of data we are generating continues to grow exponentially. Regulatory policies related to data privacy, protection, and consumer rights have introduced additional obligations on organizations. And the widespread availability of both data and software tools has dramatically lowered the barriers to entry for competitors, increasing the pressure on business leaders to “figure this out.”

As a result, many executives find themselves in the middle of a self-fulfilling prophecy: when leaders avoid data sciences investments because either the data is not trustworthy or the organization is not seen to be ready for better analytics, they guarantee the data remains untrusted and the organization remains unprepared. As Robert Frost might say, the only way out is through.

Finding Value in Data-Driven Insights

The current fascination, fear, and hype associated with artificial intelligence have raised executive awareness about the opportunity for using data and analytics in new and powerful ways. Leaders and their boards are faced with a fundamental question: what potential business value can be unlocked through investments in data sciences and analytics capabilities?

Experience has shown that building data sciences capabilities in the absence of a clear relationship to its expected business value is an excellent way to waste money. But when those investments are targeted – when the scope of work is focused on specific business questions, workflows, and insights that generate business value – the probability of success grows considerably.

Within life sciences and healthcare, data and analytics are commonly associated with several types of business value:

1. Better decisions. One of the most important benefits that data and analytics offer is raising the quality of decisions that need to be made. In our industry, data-driven decisions run a spectrum of concerns including:

- Clinical / scientific questions: issues related to patients, treatments, and research.

- Financial questions: issues related to revenue, costs, pricing, and reimbursements.

- Administrative questions: issues related to customers, employees, projects, processes, facilities, and supplies.

- Behavioral questions: issues related to activities, preferences and tendencies.

2. Faster actions with lower costs. Many insights are associated with actions that need to be taken – change study criteria, add manufacturing capacity, conduct a deeper quality review. When these actions are taken sooner, organizations experience productivity gains. In addition, as many insights need to be repeatedly created by different organizational teams, efforts that produce reusable data and analytical assets – effective data curation capabilities, for example – allow all teams to reduce repetitive, error-prone, and time-consuming data and analysis tasks and their costs. And finally, some data-driven actions can also be automated, streamlining and optimizing the use of resources for more complex tasks.

3. Lower risks. Data and analytics can be especially useful for identifying emerging risks. Is a patient’s condition declining? Is study enrollment dropping below targets? Does the current commercial pipeline support the future revenue goals? A strong data and analytics strategy enables leaders to detect risks that compromise the most important aspects of business operations and patient care.

4. Better products and customer experiences. Many organizations are discovering that a well-conceived data and analytics strategy can be used to create highly differentiated customer experiences. Customers value on-demand access to current information (i.e., what is the status), transparency with business processes (i.e., what steps have been completed), and streamlined ways of engaging with their partners (i.e., where is all of the information). By bringing disparate information together in ways that are easy to consume, organizations can create compelling products and services that drive higher customer lifetime value.

5. Stronger security and compliance. Well-developed data and analytical strategies also pay dividends in regulatory and security management. When organizations have more disciplined approaches to managing data and insights, it becomes much easier to manage security (i.e., who sees what) and regulatory (e.g., how are controls managed) obligations. In addition, data and analytics can also be used to detect patterns of electronic behaviors indicative of security or regulatory lapses (e.g., anomalous system access, excessive data retrieval).

So if these are the types of value commonly available, how do you identify which investments to prioritize?

Aligning Corporate and Insight Strategies

Historically, investment decisions regarding data and analytics were pursued relatively tactically primarily through operational reports (i.e., from line-of-business systems) and data extracts (e.g., for manipulation in Microsoft Excel). Today, we know those approaches do not scale: there are simply too many systems, data, quality issues, access control obligations, reports, and data consumers to serve. In addition, organizations need insights for more than simply good operational oversight – insights serve a more strategic function for the business.

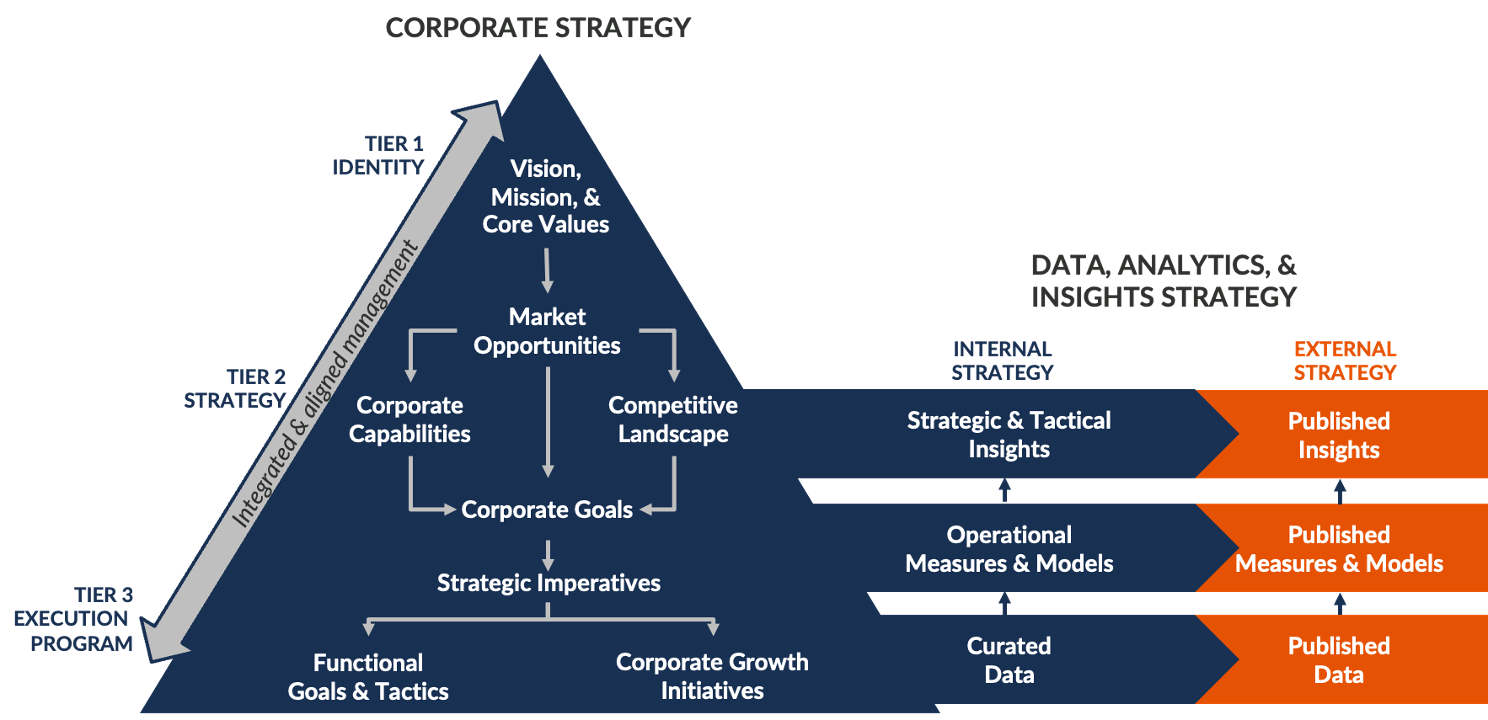

Excellent business strategies provide unambiguous focus – a lens for continuously discerning the “important” from the “good”. The same disciplines we use in strategic planning – for example, CREO’s ISEP framework (see Figure 1) – can be incredibly useful in helping organizations plan investment strategies in data and analytics. We can use strategic planning artifacts – goals, strategic imperatives, and corporate capabilities – to characterize and prioritize the internal (i.e., employee-facing) and external (i.e., visible to customers and partners) insights that best support the corporate strategy and growth goals.

Figure 1. The alignment of corporate strategy to a data, analytics, and insights strategy.

Ideally, we want to focus on investments that accelerate value creation related to our strategy. Questions we might want to explore include:

- Based on our business model and market differentiation, what data and insights are most crucial in helping us make the best decisions about our organization?

- What data and analytical capabilities would make us more valuable and attractive to investors in this market space?

- What insights would help us know whether our corporate strategy is successful?

- What time-sensitive metrics would better enable us to capture opportunities for operational improvements as we execute our strategy?

- How could data and insights facilitate a totally different customer experience with our products and services?

- How could we use data to detect and manage emerging risks for us and our customers?

- How will competitors likely use data, analytics, and insights to win business?

- How do we know if we are meeting our regulatory obligations regarding data privacy, security, and protections?

Grounded in the business value opportunities mentioned above, these questions (and others like them) serve to orient leadership thinking about data and analytics as both foundational business assets and key organizational competencies. They also help to triage insights that contribute to building trusted, data-driven cultures.

So what role are data and analytics playing in your business strategy?

Jason Burke | July 20, 2023

Jason Burke | July 20, 2023